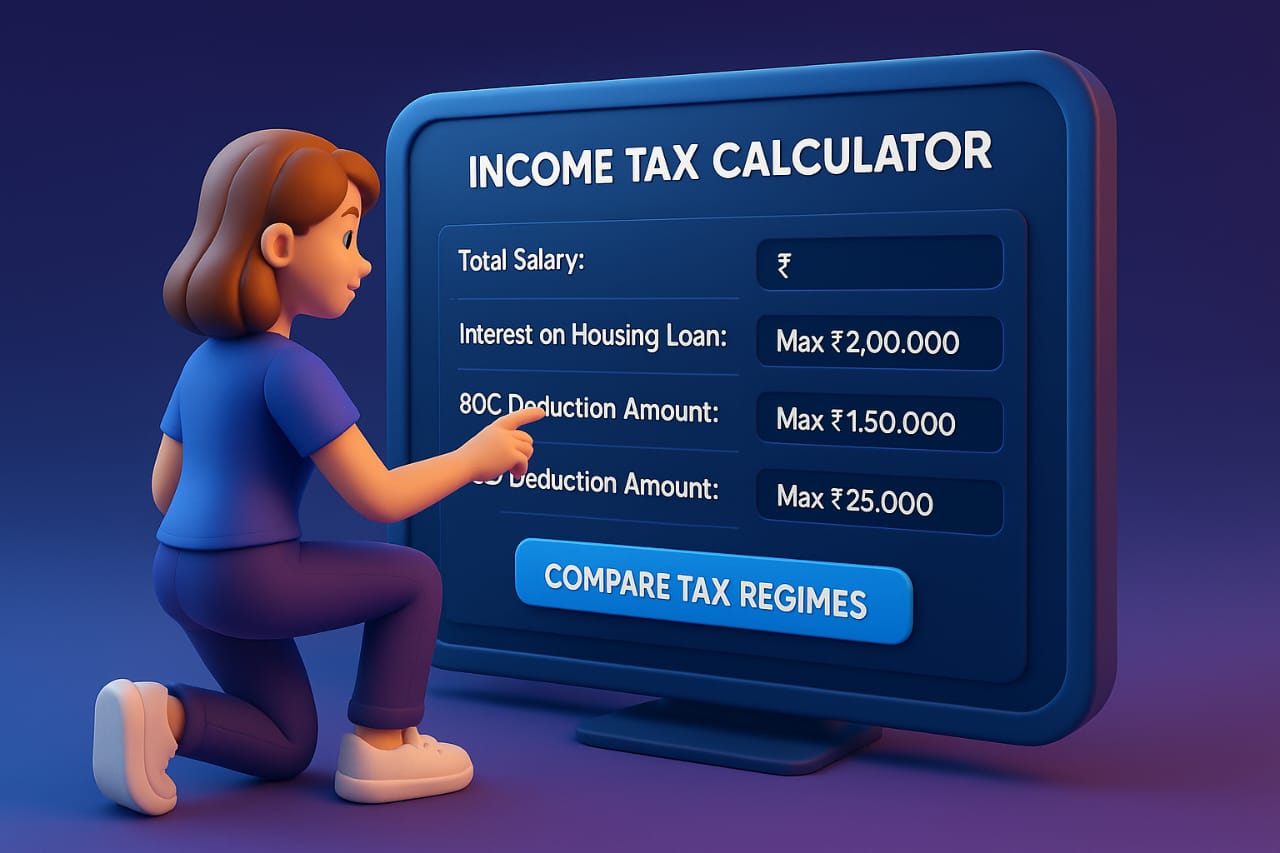

Instantly compare your income tax under old vs new regime for FY 2025–26. Use this smart calculator to check which regime gives you maximum savings.

Income Tax Calculator India

(Compare Old & New Regimes) (FY:25-26)

🧮 Compare Old vs New Income Tax Regimes (FY 2025–26) 🇮🇳

💼 BMC Income Tax Calculator – Simplify Your Tax Planning!

Are you unsure whether to choose the Old Tax Regime or the New Tax Regime under India’s income tax system for FY 2025–26? 🤔

With this simple and accurate online tax calculator, you can quickly compare both regimes and make the right financial decision.

✅ Features:

-

Enter your Total Salary

-

Add deductions like:

-

🏠 Housing Loan Interest (Section 24) – Max ₹2,00,000

-

💰 80C Deductions (LIC, PF, Tuition Fees, etc.) – Max ₹1,50,000

-

🏥 80D Medical Insurance – Max ₹25,000

-

-

Instantly get your tax liability under both regimes

-

See which regime is more beneficial for your financial planning

📊 Output Includes:

| 📌 Parameter | Old Regime | New Regime |

|---|---|---|

| Standard Deduction | ₹50,000 | ₹75,000 |

| Professional Tax | ₹2,500 | ₹0 |

| Deductions (80C, 80D, 80TTA, Home Loan) | Available | Not Available |

| Final Taxable Income | Auto-calculated | Auto-calculated |

| 💸 Tax Payable | Compared side-by-side | |

| 💡 Regime Benefit Suggestion | Highlighted clearly |

🔍 Choose smarter, save more.

💻 Try it now and take control of your income tax planning!

👉 Enter your salary and compare now!

🛠️ Developed by: Mehmood Khan